Assessing SARA’s responses

SARA is a Statement of Advice Review Assistant. But like any AI Assistant, the work still needs to be reviewed for accuracy and consistency.

This is a guide on how to cross check the results from SARA with the source documents.

Step 1: Summary of the Advice

SARA provides a summary of the advice under the following headings:

1. Objectives: List the client objectives.

2. Scope of Advice: Outline the agreed scope of the advice and any limitations to the advice.

3. Strategy Recommendations: List and summarise each of the strategic (non-product) recommendations made by the adviser.

4. Product Recommendations (if any): List and summarise the recommendations to obtain, maintain or rollover a superannuation or investment product.

5. Insurance Recommendations (if any): List and summarise the insurance recommendations.

6. Disclosure: Summarise the fees and disclosure section of the advice., including any ongoing or fixed term agreements.

Action Required: Cross Reference the response from SARA with the SOA document. Update any sections that need editing as required.

Step 2. Identifying the customer’s objectives: s961B(2)(a)

Audit Question: Did the adviser identify the objectives of the customer that were disclosed through instructions?

SARA will list out the client objectives and critically analyse each objective. The customer’s objectives should be specific, measurable and prioritised. The objectives that prompted the customer to seek advice should be clear and recorded in the customer’s own words. The Statement of Advice (SOA) should clearly explain why the customer is seeking advice and the outcomes the customer wants to achieve. The objectives should allow each customer’s relevant circumstances to be taken into account and is likely to result in advice that reflects the customer’s relevant circumstances.

Action Required: Cross check SARA’s findings with the SOA.

Did the customer file pass or fail this step? Why/Why not? If the objectives identified are not clear or specific the adviser would fail this step. Outline that this is a breach of safe harbour and s961B(2)(a), and what steps the adviser can take to remediate the file.

Step 3: Identifying the customer’s financial situation and needs: s961B(2)(a)

Audit Question: Did the adviser identify the financial situation and needs of the customer?

SARA will list the following details:

the client/s personal circumstances including age, relationship status and family situation;

health status

total income, expenses and net cashflow

total assets

total liabilities

superannuation funds name and balances

any pension funds name and balances

insurance policies names and benefits

Action Required: Cross check SARA’s findings with the SOA.

Did the customer file pass or fail this step? Why/Why not?

If the customer file does not demonstrate that the adviser adequately identified the customer's financial situation and needs, the customer file would fail this step. Outline that this is a breach of safe harbour and s961B(2)(a), and that the adviser needs to review the current financial situation with the client to obtain up to date and accurate information.

Step 4: Identifying the customers risk profile: s961B(2)(a)

Audit Question: Has the adviser identified the clients risk profile?

What was the risk profile identified for the client/s?

Is this risk profile appropriate for the clients personal circumstances? When assessing the appropriateness of the risk profile, consider the clients age, assets, income and investment timeframe. A stable financial situation with a long investment horizon might allow for higher risk investments.

Action Required: Cross check SARA’s findings with the SOA.

Did the customer file pass or fail this step? Why/Why not?

If the adviser has not identified the client/s risk profile, or the risk profile does not seem appropriate for the clients age or investment timeframe the adviser fails this step. Outline that this is a breach of safe harbour and s961B(2)(a), and that the adviser needs to review the client risk profile to ensure it is appropriate for the client circumstances.

Step 5: Identifying the subject matter and scope of the advice: s961B(2)(b)(i)

Audit Question: Did the adviser identify the scope of the advice sought by the customer and, where relevant, limit the scope of the advice accordingly?

SARA will outline the agreed scope of advice. If the adviser has limited the scope, SARA will outline what has been limited and why it has been limited.

Do the recommendations made by the adviser reflect the scope that was decided with the customer? Did the adviser provide recommendations within the boundaries of the agreed scope?

Action Required: Cross check the response with the SOA and investigate whether the adviser's recommendations were within the bounds of the agreed upon scope.

Did the customer file pass or fail this step? Why/Why not?

If the adviser did not identify the scope of advice, or provided advice that was outside in the bounds of the agreed scope, the adviser fails this step. Outline that this is a breach of safe harbour and s961B(2)(b)(i), and that the adviser needs to review the scope of advice with their client.

Step 6: Recommending a financial product: s961B(2)(e)

Audit Question: Has the adviser made a recommendation to maintain or obtain a superannuation or investment financial product?

Where a superannuation or investment financial product is recommended, SARA will asses if it was reasonable to recommend a financial product, taking into account the reasons why the customer sought advice?

What are the reasons why the adviser believes the recommended superannuation or investment products are suitable for the customer.

It should be clear that the recommended superannuation or investment product meet the stated objectives and needs of the customer.

Action Required: Cross check the response from SARA with the recommendation in the SOA.

Does the adviser pass or fail this step? Why/Why Not?

If there is a clear link between the clients stated objective and how the recommended superannuation or investment product meets that objective, the adviser passes this step.

If the recommended superannuation or investment products do not meet the stated objective of the client, the adviser fails this step. Outline that this is a breach of safe harbour and s961B(2)(e), and what the adviser needs to do to remediate the file.

Step 7: Making a recommendation to replace a financial product: s961B(2)(e)

Audit Question: Has the adviser made a recommendation to maintain or obtain a superannuation or investment financial product?

If a superannuation or investment product has been replaced, check for the following:

1. Did the adviser consider the clients existing superannuation or investment product and clearly explained why it is not appropriate? Failing consider the clients existing product is a breach of s961B(2)(e).

2. Does the recommended product satisfy the clients stated objective?

3. Has the adviser provided a detailed fee comparison table in the Product Replacement section?

4. Does the replacement of product result in lower fees? If the recommendation does not result in lower fees, how does the increase in fees meet the clients stated objective?

5. Has the adviser outlined other products that were considered? If so, list what other products were considered and why were they discounted?

Actions Required: Cross check the response from SARA and the recommendations made in the SOA.

Does the adviser pass or fail this step? Why/Why Not?

If the files meets the above criteria, the adviser passes this step. If the file does not meet the criteria, the adviser fails this step. Outline that this is a breach of safe harbour and s961B(2)(e), and what the adviser needs to do to remediate the file.

If the adviser had not replaced superannuation or investment product, this step is not applicable.

Step 8: Recommending a financial product - Investment Portfolio Recommendations: s961B(2)(e)

Audit Question: Has the adviser made a recommendation to buy and/or sell any investments?

SARA will list and summarise the recommended transactions to be made.

Where an investment portfolio is recommended, is the asset allocation within the clients risk profile?

Is there a variation greater than 10% for each asset class? Does the adequately adviser explain any variations?

Actions Required: Cross the SARA’s response with the portfolio and asset allocation in the SOA.

Does the adviser pass or fail this step? Why/Why Not?

If the recommended portfolio asset allocation variation is less than 10%, the adviser passes this step.

If the variation is greater than 10%, has the adviser adequately explained the variation? If the adviser fails this step, Outline that the adviser needs to review the recommended asset allocation.

Step 9: All judgments are based on customer's relevant circumstances: s961B(2)(f)

Audit Question: Has the adviser based all judgments made, in advising the customer, on the customer’s relevant circumstances?

SARA will summarise each of the recommendations made by the adviser and critically analyse each of the recommendations made by the adviser. Looking for clear links between the customer's stated objective and how the advice satisfies that objective.

Action Required: Cross check SARA’s response with the SOA. Has the adviser considered the reasons, consequences and alternative strategies considered for the recommendations?

Does the adviser pass or fail this step? Why/Why Not?

To satisfy s961B(2)(f), a reasonable adviser would believe the customer is likely to be in a better position if the customer follows the advice. If the advice clearly satisfies the client objective, the file passes this step.

If the advice does not clearly reflect the customer’s relevant objective, or if there seems to be a mismatch between the objective and the advice, the customer file would fail this step. Outline this is a breach of best interest duty and s961B(2)(f).

Step 10: Recommending a financial product - life insurance needs analysis: s961B(2)(e)

Audit Question: Where an insurance product is recommended, has the adviser completed a needs analysis to calculate the appropriate levels of cover required?

SARA will outline the levels of cover recommended and the basis for the needs analysis in the event of life, total and permanently disablement, traumatic illness and if the client is unable to work.

It should be clear that the recommended level of cover meets the clients objectives and needs of the customer.

Actions Required: Cross check the SARA responses with the SOA.

Does the adviser pass or fail this step? Why/Why Not?

If the adviser has completed a thorough needs analysis calculation and there is a clear link between the clients stated objective and the level of cover, the adviser passes this step.

If the adviser has not completed a thorough needs analysis, the adviser fails this step.

If the adviser has not made a recommendation to maintain or obtain insurance, this step is not applicable.

Step 11: Making a recommendation to replace a life insurance product: s961B(2)(e)

Audit Question: Has the adviser made a recommendation to replace a life insurance product?

S

ARA will review the product replacement section of the insurance recommendation for the following:

1. Has the adviser clearly explained why the existing product is not appropriate?

2. Does the recommended product replacement satisfy the clients stated objective?

3. Has the adviser provided a detailed fee comparison table in the Insurance Product Replacement section and included the benefits gained and the benefits lost?

4. Finally, does the replacement of product result in lower fees?

Actions Required: Cross check the SARA responses with the SOA.

Does the adviser pass or fail this step? Why/Why Not?

If the files meets the above criteria, the adviser passes this step.

If the file does not meet the criteria, the adviser fails this step.

If the adviser has not made a recommendation to replace an insurance product, this step is not applicable.

Step 12: Information about fee disclosure and any remuneration or commission: s947B (2) (d)

Audit Question: Does the Statement of Advice include a section that discloses the fees payable by the client?

SARA will list the following fees charged by the adviser:

A fee for the preparation of the advice.

A fee for implementation of the advice.

An ongoing or annual advice fee.

Upfront commission receivable for life insurance product/s (if applicable).

Ongoing commission receivable for the life insurance products (if applicable).

Action Required: Cross check the SARA response with the Fee Disclosure section in the SOA .

Does the adviser pass or fail this step? Why/Why Not?

If the Statement of Advice includes the above disclosure, the file passes this step.

If the advisers above remuneration is not disclosed, the file fails this step.

If the product fees are not included, the adviser fails this step.

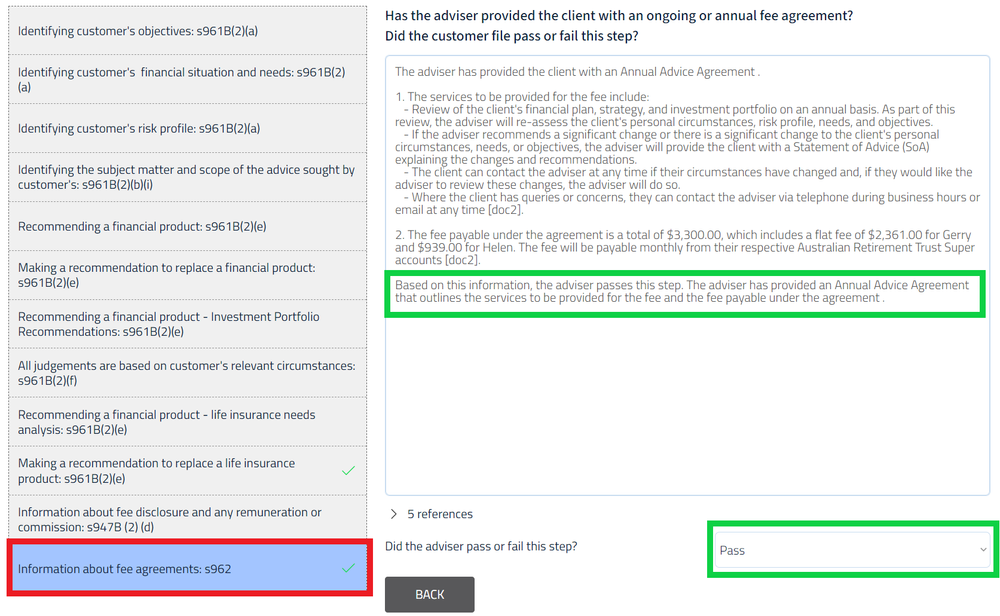

Step 13: Information about fee agreements: s962

Audit Question: Has the adviser provided the client with an ongoing or annual fee agreement?

SARA will summarise the services and costs under the agreement:

1. What are the services to be provided?

2. What are the fees payable under the agreement? Who will pay the fee and from which account?

Action Required: Cross check the SARA response with the Fee Agreement.

If the files meets the above criteria, the adviser passes this step. If the file does not meet the above criteria, the adviser fails this step

Step 14: Printing the Report

Print the Report

Action Required: Click the ‘Print’ button to download report. Once downloaded, you can run a final check before PDF the file.

Action Required: Upload to iC2 SOA

Upload the Compliance Report to the SOA Request in the ‘SOA Audit’ section.

Update the SOA Status accordingly, and email the adviser with a notification of approval or any changes to be made.